Mental health and insurance: Supporting your clients during difficult times

Mental health and insurance: Supporting your clients during difficult times

Concerns around mental health are currently one of the biggest challenges facing many Australians – and this is reflected in the numbers.

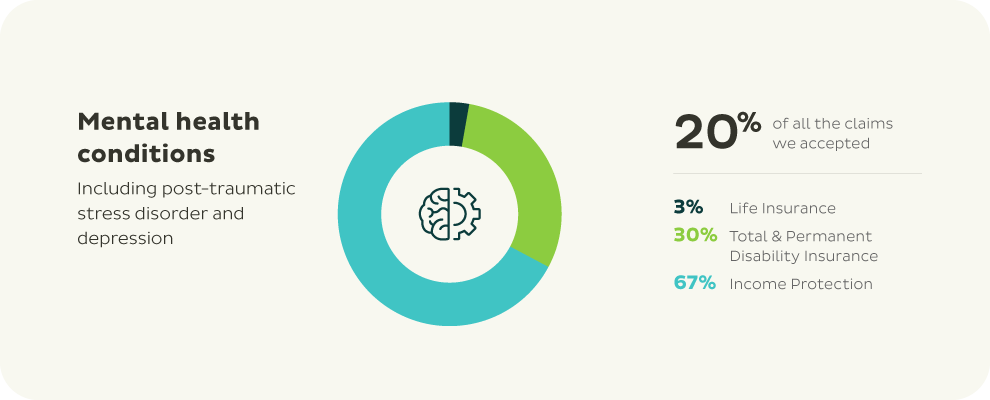

Over the years, mental health conditions have increasingly become the number one reason for customers to claim, making up 20% of all the claims we accepted in the 2023/2024 financial year period¹.

With claims for mental health conditions continuing to grow, we are committed to doing more to identify, prevent and support Australians with mental health conditions. Mental illness is a complex area, and we are continually working to increase our understanding – and support you with resources to have conversations with your clients around mental health.

Mental health and insurance

We’ve created a new mental health brochure which includes everything you need to know about mental health conditions and how they may impact your client’s life insurance.

From prevalence of mental health conditions, to underwriting exclusions and claims, the brochure explores stats and insights, with a case study to help you to position your advice recommendations for clients living with mental health conditions. You’ll also find valuable tools and resources to help you navigate the area of mental health when advising your clients, or indeed for your own mental health care.

Education on mental health through TAL Risk Academy

TAL Risk Academy continues to support advisers throughout the year with a professional development program aimed at reinforcing mental health awareness. This offers a range of on-demand CPD learning, workshops and resources to help boost knowledge in the mental well-being space.

Mental Wellbeing: Thriving in the financial advice industry |

Mental Wellbeing: Supporting at-risk clients |

Supporting grieving clients: Fireside chat with the experts |

Supporting clients at claim time |

Your role as an adviser

We know these conversations can feel uncomfortable for many. TAL’s Value of Advice research shows that 38% of advisers don’t feel confident dealing with a distraught client, and when this becomes a claim, 42% of advisers revealed they sometimes avoid difficult conversations with clients about claims.

We’re here to help you build the skills and knowledge you need to support your clients and understand their situation, enabling you to confidently approach the topic with care and empathy. For any questions or additional support, please get in touch with your TAL Business Development Manager

1Claims statistics based on total number of assessed claims (including funeral insurance) that were accepted between 1 April 2023 and 31 March 2024. A claim is assessed in order to determine whether or not the claim is payable. A claim is accepted when the claim is determined to be payable