Phase three of the LIF reforms

Here's what you need to know to get ready for 2020

What you need to know about Commission Changes

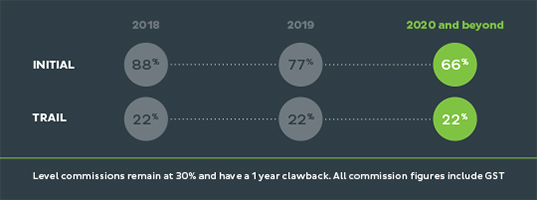

From 1 January 2020, new policy commissions will reduce to 66%.

Remember, commissions are paid on:

- The premium once all the relevant discounts/rebates are applied

- The premium before the 15% premium tax rebate is applied on annual rollover

- All permanent and temporary loadings.

And not paid on:

- Policy fees or stamp duty (where it is charged separately)

- The frequency loading for monthly or quarterly premium payments

- Waived or refunded premiums.

What you need to know about

Grandfathering

- Policies written on pre-LIF terms will retain the commission terms on which they were originally written

- Any policies written on LIF commission terms are not grandfathered, so increases or additions to these policies are limited to maximum initial commission of 66% from 1 January 2020

- Any applications not commenced by 31 December 2019 will be subject to the maximum initial commission rate of 66%

- Please be aware that any application requirements which are not fulfilled by 31 December 2019 or rollovers not received and allocated by us by 31 December 2019 will not receive the 77% (including GST) rate of commission applicable until 31 December 2019.

Transition arrangements

- There isn’t a transition period for the phase three commission changes, which have a hard cut-off of 31 December 2019.

- Any business completed on or after that will receive 66% commission, including increases and additions to existing policies on LIF terms

- Premiums paid by rollover have to be received and allocated by 31 December 2019. Payment after that will require the hybrid commission to be paid at 66%.

- Make sure application requirements are fulfilled and rollovers requested early in December to avoid the reduction in your initial commission

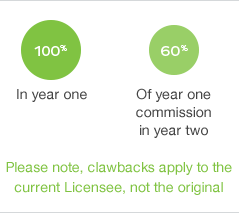

A reminder about clawback rules

Initial commissions will be clawed back for policy cancellations or reductions in policy costs at the following rates:

These rules apply to

- Cancelled policies

- Reduced premiums due to a cancellation of benefit or option, or a reduction in the sum insured

- Reduced premiums due to some policy alterations, like a waiting period increase or switch from level to stepped premiums.