LIF phase two: Getting ready

|

| On 1 January 2019, the next phase of the Life Insurance Framework (LIF) reforms will begin. We’re here to help you and your business get LIF-ready with our checklist of things you need to know and do right now. |

|

|

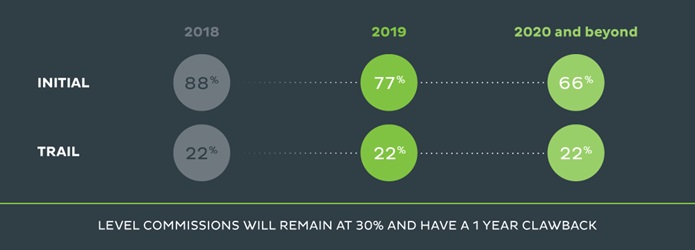

Policies written on pre-LIF terms will continue to retain the commission terms which they were originally written. Any policies written on LIF commission terms are not grandfathered – this means that increases or additions to these policies will be limited to maximum initial commission of 77% from 1 January 2019 and 66% from 1 January 2020. Any new business or alterations not completed by 31 December 2018 will be subject to the maximum initial commission rate of 77%. |

In accordance with the legislative requirements, there will be no transition period on the changes to initial commission rates on 1 January 2019. Any business completed on or after this date will receive a maximum of 77% initial commission. This includes increases and additions to any existing policies written on LIF terms. IMPORTANT – APPLICATIONS FUNDED BY ROLLOVER PROCEEDS If your client is funding their application via a rollover from their super fund, rollover proceeds must be received and allocated by 31 December 2018 for the policy to be put into force. As we do not have authority to obtain information or follow up outstanding rollovers with your clients’ fund, you should ensure that application requirements are fulfilled and rollovers requested as soon as possible as by law we will not be able to pay pre 1 January 2019 commission rates for policies issued after 31 December 2018. |

Since the introduction of LIF reforms on 1 January 2018, initial commissions will be clawed back for policy cancelations or reductions in policy costs at the following rates:  These rules apply to:

|

HAVE QUESTIONS OR NEED MORE INFORMATION?

We have put together a FAQ which will provide more detailed information about the changes.

Of course we’ll keep you updated as the reforms roll out, but in the meantime if you would like to discuss please get in touch with your local TAL Sales team member or our Adviser Services Team if you have any questions. Adviser Services are available on 1300 286 937 between Monday to Friday 8:00am - 7:00pm (AEST) or via email.