Help your clients get ready for tax time

Tax time is almost here, and we’ll soon be getting in touch with your clients to let them know when to expect their annual Income Protection summary.

- TAL clients will be sent their Income Protection summary and annual S290 notices by 30 July 2024. We’ll send it via email to clients who’ve provided us with their email address. Otherwise, we’ll send it by post.

- Asteron clients can expect to receive their Income Protection summary via mail by 22 July 2024.We’ll send it via email to clients who’ve provided us with their email address. Otherwise, we’ll send it by post.

- BT, Westpac and St George clients will be sent their Income Protection summary via post by 30 July 2024.

To help you support your clients, a copy of their annual Income Protection summaries will be available for you to access on the TAL Adviser Centre (TAC). We anticipate that:

- TAL client statements will be available on TAC by 29 July 2024.

- Asteron client statements will be available on TAC by 29 July 2024.

- BT, Westpac and St George client statements will be available on TAC by 29 July 2024.

If you need help finding or downloading your client’s summary, click the link for detailed instructions on how to access the information for each brand.

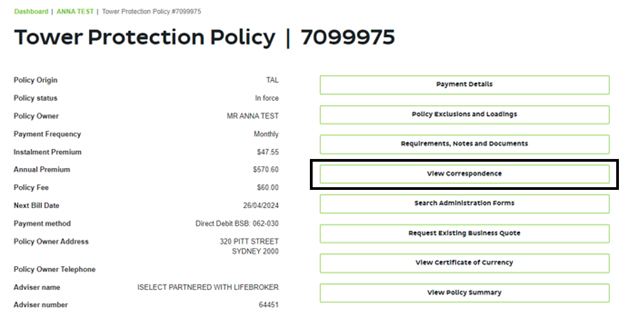

For TAL Clients:

To help you support your clients with their TAL policy at tax time, we anticipate a copy of their annual Income Protection summary will be available for you to access on the TAL Adviser Centre (TAC) by 29 July 2024.

Log in to TAC and follow the steps below to download a copy of your TAL client’s summary:

- Click the Search button at the top-right

- Enter a Policy Number or search using the Policy Filter

- Select the + icon beside client name

- Click the View Policy link, to present the Policy Details page

- Click the View Correspondence button to view the correspondence archive. Your client’s annual Income Protection summary will be available for download.

If you have any questions about these updates or need further support for TAC, please reach out to your Business Development Manager.

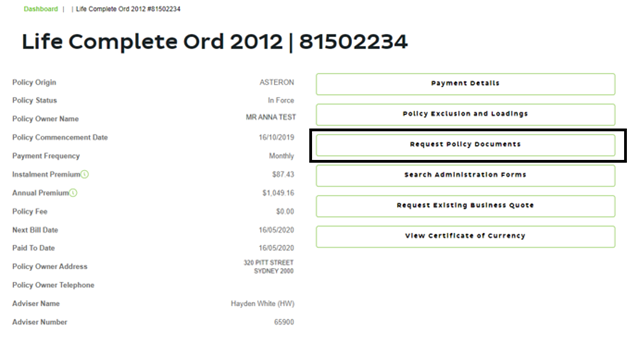

For Asteron Clients:

To help support conversations with your Asteron clients come tax time, a copy of their annual Income Protection summary and annual s290 notices will be sent by request via the TAL Adviser Centre (TAC) from 22 July 2023.

Log in to TAC and follow the steps below to download a copy of your Asteron client’s summary:

- Click the Search button at the top-right

- Enter a Policy Number or search using the Policy Filter

- Select the + icon beside client name

- Click the View Policy link, to present the Policy Details page

- Click the Request Policy Documents button

- Click the ‘Tax Document’ option and delivery preference to make your request (please allow 3 – 5 business days).

If you have any questions about these updates or need further support for TAC, please reach out to your Business Development Manager.

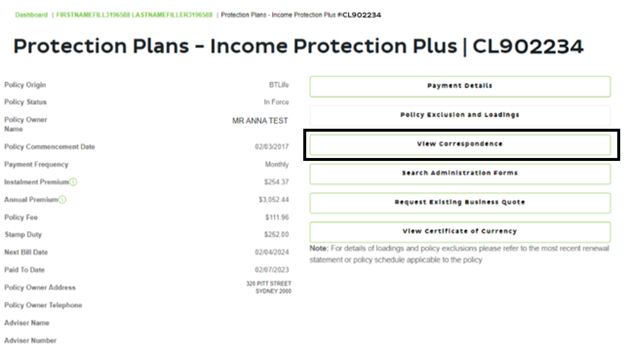

For BT, Westpac and St George Clients:

To help support conversations with your BT, Westpac and St George clients come tax time, a copy of their annual Income Protection summary will be sent by request via the TAL Adviser Centre (TAC) from 30 July 2024.

Log in to TAC and follow the steps below to download a copy of your Asteron client’s summary:

- Click the Search button at the top-right

- Enter a Policy Number or search using the Policy Filter

- Select the + icon beside client name

- Click the View Policy link, to present the Policy Details page

- Click the View Correspondence button to view the correspondence archive. Your client’s annual Income Protection summary will be available for download.

If you have any questions about these updates or need further support for TAC, please reach out to your Business Development Manager.