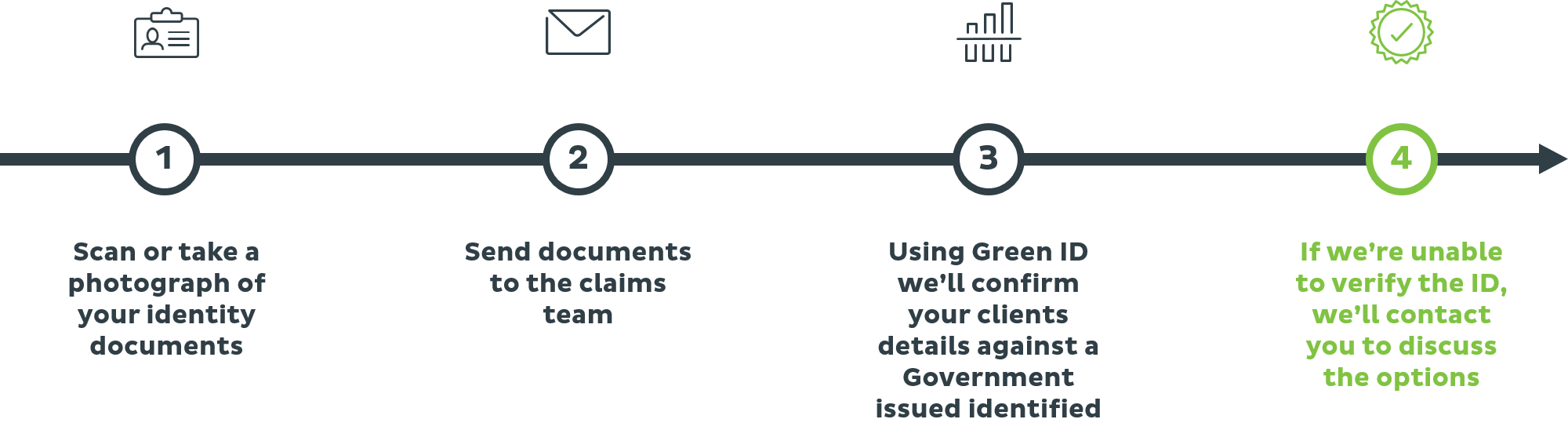

The simple process to verify your client's ID at claim time

The simple process to verify your clients ID at claim time

We’re always focussed on processing your clients’ claims as quickly as possible, and with the challenges we’re facing right now we want you to know that we have the right systems in place to do just that.

Our online identify verification platform called Green ID enables us to verify your client’s identity against reliable and trustworthy data sources in real-time. Green ID securely verifies your client’s identity which results in a quicker, easier experience as it eliminates the need for your client to send us certified identification documents.

Securely verifying identification online

A key part of our claims assessment process involves obtaining verified identification for the beneficiary of the policy. This ensures that there are no delays in processing the claims payment once the assessment has been finalised. The benefit of using Green ID is that when your client’s identification is successfully verified, there will be no need to provide certified identification documents creating an easier and quicker experience.

How to use Green ID

When notifying us of a claim, your client will be offered the option of having their identity verified online. All we’ll need is a scanned copy or photograph of their driver’s licence or passport. Green ID’s secure platform confirms your client’s details against a Government-issued identifier and if this is successful, no further identify documentation is required.

If identification cannot be verified using Green ID or if your client prefers to opt out of having their identity verified using Green ID, your client will be asked to provide a certified copy of an identification document such as the passport page of their passport or their driver’s licence. An identity document can be posted or emailed with the completed claim form or as soon as it’s ready.

For further information on Green ID, please contact your TAL Business Development Manager.